Absorption Costing Questions and Answers

Get your Homework Questions Answered at Transtutors in as little as 4 Hours. All College Subjects covered - Accounting Finance Economics Statistics Engineering Computer Science Management Maths Science.

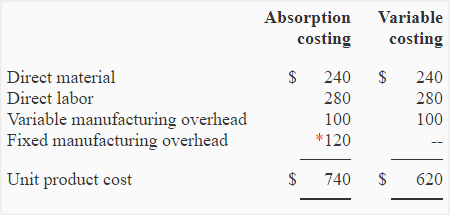

Exercise 1 Unit Product Cost Under Variable And Absorption Costing Accounting For Management

The figure below illustrates the structure of Absorption and Variable costing method CO-PA Organization Structure.

. Calculate what the manufacturing cost per unit is under absorption costing and variable costing. Product costing C. After weighing these bricks are placed in water with full immersing for a period of 24 hours.

Explain why the net income may be different between absorption and variable costing. Accounting questions and answers. Use the Process Costing method.

Denton Company manufactures and sells a single product. The method of calculating the total cost of production by calculating the cost of different processes separately is called process costing. MCQ Questions and Answers on Financial Accounting.

Here we share a list of frequently asked civil engineering interview questions and answers to assure your success in the interview. Target costing is very much a marketing approach to costing. Financial Accounting Questions and Answers Test your understanding with practice problems and step-by-step solutions.

Product and period cost according to absorption costing and Variable costing with examples. Sales 2600000 Variable production costs 1300000 Contribution Margin. Statement of Comprehens When prices for raw materials and other purchased good are increasing LIFO valuation will result in a higher Cost of.

Find answers to questions asked by students like you. The difference between dry and wet brick weights will give the amount of water absorption. Under the full costing method fixed manufacturing overhead costs are expense when the product is sold.

What is Concrete Grade. The main purpose of the Activity-Based Costing ABC. The budgeted costs sales and volumes for the next financial year are set as follows.

Multiple choice questions and answers cma mcq FOR BCOMCACSCMA EXAM HELLO GUYS IN THIS PAGE YOU WILL GET MORE THAN 200 MCQS TYPES ON AUDITING WHICH ARE ASKED REGULARY IN VARIOUS EXAMS. A Net payment method. According to IS 456-2000 concrete is graded into three types.

Under the direct costing method fixed manufacturing overhead costs are expense during the period in which they are incurred. Absorption costing is a method where all the cost related to the manufacturing process is considered. In what types of industries use the process costing method.

Costing may involve only the assignment of variable costs which are those costs that vary with some form. Costing is any system for assigning costs to an element of a business. Then weigh the wet brick and note down its value.

Accountants treat a business as distinct from the persons who own it. Absorption costing format b. Browse through all study tools.

Costing is typically used to develop costs for customers distribution channels employees geographic regions products product lines processes subsidiaries and entire companies. The Chartered Institute of Marketing defines marketing as. Industries like chemicals textiles food Steel Sugar Shoes Petrol etc.

Cost data for the product are. Concrete is designated based on its compressive strength at 28 days as measured in standard conditions with a 150 mm size cube. When the purchase consideration is given directly by stating the amount to be paid by the purchasing company to the shareholders of the vendor company.

Income Statement Questions and Answers. For a good quality brick the amount of water absorption should not exceed 20 of weight of dry brick. Throughput and absorption accounting methods in respect of profit reporting and inventory valuation.

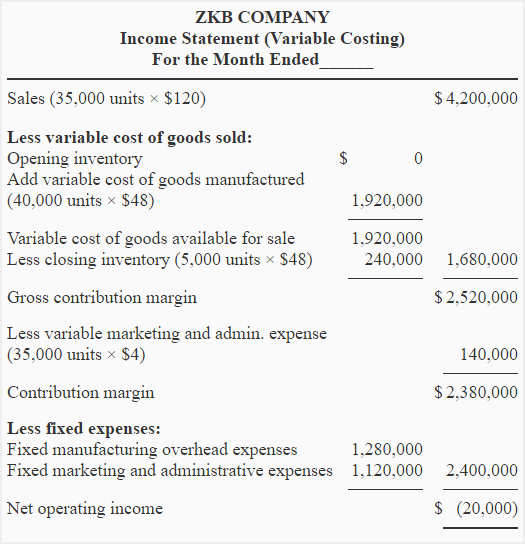

The management accountant at Clarkson Company has prepared the following income statement for March using variable costing. Past paper questions and answers from the 2010 syllabus that are still relevant to the CIMA P1 paper. Compare and contrast activity-based costing with traditional marginal and absorption costing methods.

Activity-Based Costing ABC is the costing that begins with the tracking of activities and then the output of the product. Computation of Unit Product Cost - Absorption Costing Particulars Per unit Unit Product Cost Q. Checkers Limited manufactures three key product lines A B and C.

What is the main purpose of Activity-Based Costing ABC. QUESTION 4 SEPT 2012 The following are the statement of comprehensive income and statement of changes in equity of Jamil Bhd and Jamilah Bhd for the year ended 30 April 2012. In other words it is the costing method mechanism that focuses on activities conducted for the manufacture of goods.

The management process responsible for identifying anticipating and satisfying customer requirements profitably In marketing customers rule and marketing departments attempt to find answers to the following questions. P1 May 2013 question 2dii. Managers can use variable costing information for internal decision making but they must use absorption costing for external reporting purposes.

Overheads allocated and apportioned to production departments including service cost centre costs were to be recovered in product costs as follows. There is beginning inventory of 6000 units and the company wants 12000 units in ending inventory. If the actual amount of overhead turns out to be different from the standard amount of overhead then the overhead is said to be either under absorbed or.

When a company uses standard costing it derives a standard amount of overhead cost that should be incurred in an accounting period and applies it to cost objects usually produced goods. The expected sales for next year are 50000 units.

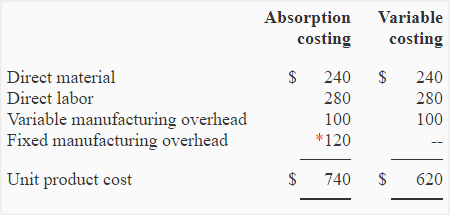

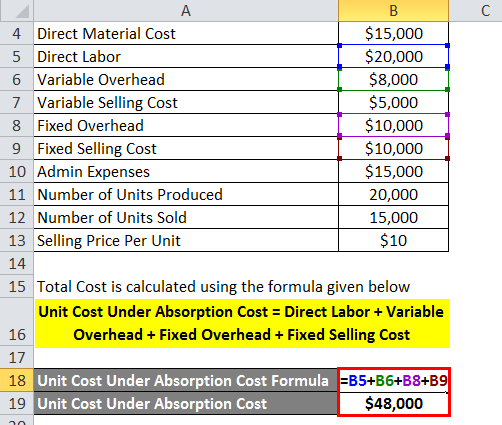

Absorption Costing Formula Calculation Of Absorption Costing

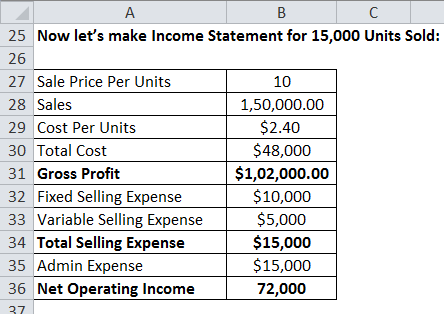

Problem 2 Variable And Absorption Costing Unit Product Costs And Income Statements Accounting For Management

Absorption Costing Formula Calculation Of Absorption Costing

No comments for "Absorption Costing Questions and Answers"

Post a Comment